Understanding the world of finance requires navigating a complex landscape of investment vehicles. A crucial component of this landscape is the Currency ETF, a type of exchange-traded fund that tracks the performance of a specific currency or basket of currencies. This allows investors to gain exposure to foreign exchange markets without directly trading currencies themselves, offering a potentially simpler and more accessible route. The appeal of the Currency ETF lies in its ability to diversify portfolios and potentially hedge against currency fluctuations. It’s important to understand the underlying mechanics and potential risks before investing in such a product.

What is a Currency ETF?

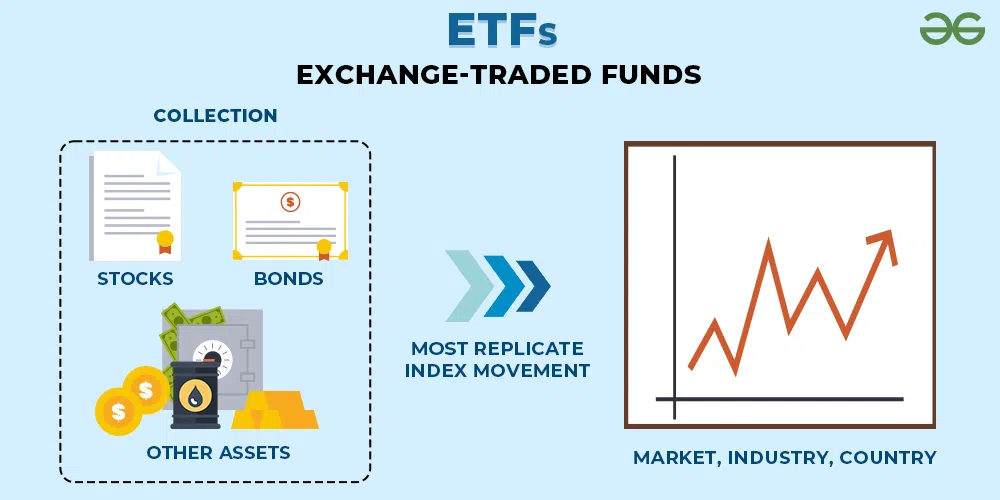

A Currency ETF, or Exchange-Traded Fund, is an investment fund that holds a portfolio of currency assets. Unlike traditional ETFs that track stock indices or bond markets, currency ETFs focus on the value of one or more foreign currencies. These ETFs typically replicate the performance of a specific currency by holding contracts that reflect its value against another currency, usually the US dollar. The value of the ETF shares then fluctuates based on the performance of the underlying currency or currency basket.

How Currency ETFs Work

- Tracking Performance: The primary goal of a Currency ETF is to closely mirror the price movements of its target currency.

- Currency Exposure: They provide a relatively straightforward way for investors to gain exposure to foreign exchange markets.

- Investment Strategies: Currency ETFs can be utilized for various investment strategies, including speculation, hedging, and portfolio diversification.

Special Considerations When Investing in Currency ETFs

Investing in Currency ETFs, while seemingly straightforward, requires careful consideration. Currency markets are notoriously volatile and influenced by a multitude of factors, including economic indicators, political events, and global news. This inherent volatility can lead to significant fluctuations in the value of your investment.

- Volatility: Currency markets are highly volatile and susceptible to unexpected swings.

- Economic Factors: Interest rate differentials, inflation rates, and economic growth can all impact currency values.

- Geopolitical Risks: Political instability and global events can significantly influence currency exchange rates.

- Management Fees: Like all ETFs, currency ETFs charge management fees, which can erode returns. It’s crucial to compare fees across different ETF options.

Furthermore, understanding the specific structure of the ETF is crucial. Some ETFs hold physical currencies, while others utilize currency futures contracts. These different approaches can lead to varying levels of tracking error and potential risks. It’s wise to conduct thorough research and consult with a financial advisor before investing.

Examples of Currency ETFs

Several Currency ETFs are available, each tracking different currencies or baskets of currencies. Here are a few examples:

While these are just a few examples, the availability and specific features of Currency ETFs can change. It is always advisable to consult with a financial professional before making any investment decisions.

| ETF Ticker | Currency Tracked | Description |

|---|---|---|

| FXE | Euro | Tracks the price of the Euro relative to the US Dollar. |

| FXY | Japanese Yen | Mirrors the performance of the Japanese Yen against the US Dollar. |

| FXC | Canadian Dollar | Tracks the value of the Canadian Dollar versus the US Dollar. |

Finally, the long-term viability of a Currency ETF as an investment depends on a multitude of factors, including global economic trends and individual risk tolerance.

But imagine, dear reader, a twist in the tapestry. What if Currency ETFs evolved beyond mere trackers of fiat’s fickle fortunes? Envision “Currency ETFs 2.0,” funds interwoven with the threads of decentralized finance. Perhaps an ETF that not only holds Euros but also allocates a percentage to yield-farming platforms, generating passive income pegged to the Euro’s value. Or a Yen-backed ETF that participates in blockchain-based lending protocols, offering investors a slice of the DeFi pie while maintaining exposure to the traditional currency.

The Dawn of Crypto-Currency Hybrids

The future could hold ETFs that blend the stability (or perceived stability) of government-backed currencies with the innovative power of cryptocurrencies. These hybrid ETFs could offer investors a compelling proposition: exposure to established markets combined with the potential for higher returns through DeFi participation. Think of it as a financial chimera, a creature born from the union of old and new, traditional and disruptive.

Challenges and Opportunities

- Regulatory Hurdles: Navigating the regulatory landscape for these hybrid ETFs would be a monumental task. Regulators worldwide are still grappling with the complexities of DeFi, and incorporating it into traditional financial products would require careful consideration and potentially new legislation.

- Smart Contract Risk: The underlying smart contracts that govern DeFi protocols are not without risk. Bugs, exploits, and impermanent loss could all impact the performance of a hybrid ETF.

- Transparency and Auditing: Ensuring transparency and proper auditing of the DeFi components would be crucial for investor confidence.

Despite these challenges, the potential rewards are significant. Hybrid ETFs could democratize access to DeFi, allowing a broader range of investors to participate in the burgeoning world of decentralized finance. They could also provide a much-needed bridge between the traditional financial system and the blockchain ecosystem, fostering greater understanding and adoption of cryptocurrencies.

Beyond the Horizon: The Currency ETF Singularity

Let’s venture even further into the realm of possibility. Imagine Currency ETFs that are dynamically adjusted based on artificial intelligence algorithms. These AI-powered ETFs would analyze vast amounts of data – economic indicators, social media sentiment, geopolitical events – to predict currency fluctuations and adjust their holdings accordingly. They would be like self-driving cars for your portfolio, constantly optimizing for maximum returns.

| Feature | Traditional Currency ETF | AI-Powered Currency ETF |

|---|---|---|

| Investment Strategy | Passive tracking of a currency or basket of currencies. | Dynamic allocation based on AI-driven predictions. |

| Data Analysis | Limited to traditional economic indicators. | Analyzes vast amounts of data, including social media and geopolitical events. |

| Risk Management | Based on historical volatility and predefined parameters. | Adaptive risk management based on real-time market conditions. |

These futuristic ETFs could even incorporate elements of behavioral economics, anticipating and capitalizing on the irrational behaviors of market participants. They would be the ultimate embodiment of data-driven investing, a testament to the power of artificial intelligence to transform the financial landscape.

So, as you consider the humble Currency ETF today, remember that its future is far from certain. It may remain a simple tool for tracking foreign exchange rates, or it may evolve into something far more complex, a hybrid creature of code and currency, guided by the invisible hand of artificial intelligence. The possibilities, like the currencies they track, are ever-shifting and full of untold potential.