The landscape of cryptocurrency taxation in the United States is in constant flux, making it increasingly important for investors and traders to stay informed. Understanding how the IRS views and taxes digital assets like Bitcoin and Ethereum is crucial for avoiding penalties and ensuring compliance. The evolving nature of these laws means that what was true last year may no longer be the case, demanding proactive learning and adaptation. This guide aims to provide a comprehensive overview of the shifting terrain of cryptocurrency tax laws, equipping you with the knowledge necessary to navigate the complexities of filing your crypto taxes accurately.

Understanding the IRS’s Perspective on Cryptocurrency

The Internal Revenue Service (IRS) treats cryptocurrency as property, not currency. This classification has significant implications for taxation. Every time you sell, trade, or otherwise dispose of cryptocurrency, you create a taxable event. This means you’ll likely need to report capital gains or losses on your tax return, depending on whether you sold the asset for more or less than you purchased it for.

Key Taxable Events Involving Cryptocurrency

- Selling cryptocurrency for fiat currency (e.g., USD)

- Trading one cryptocurrency for another

- Using cryptocurrency to purchase goods or services

- Receiving cryptocurrency as income (e.g., payment for services)

Changes in Cryptocurrency Tax Laws

Several key changes and updates have impacted cryptocurrency tax laws in recent years. These changes can affect how you report your crypto activity and the amount of taxes you owe.

- Increased Scrutiny: The IRS has significantly increased its scrutiny of cryptocurrency transactions. They are using data analytics to identify potential tax evasion and are sending out more warning letters to taxpayers who may have underreported their crypto income.

- New Reporting Requirements: Tax forms are evolving to better capture cryptocurrency transactions. Keep an eye out for new fields and schedules related to digital asset reporting.

- Guidance on Staking and DeFi: The IRS is still developing clear guidance on the taxation of staking rewards and decentralized finance (DeFi) activities. This area remains complex and often requires professional tax advice.

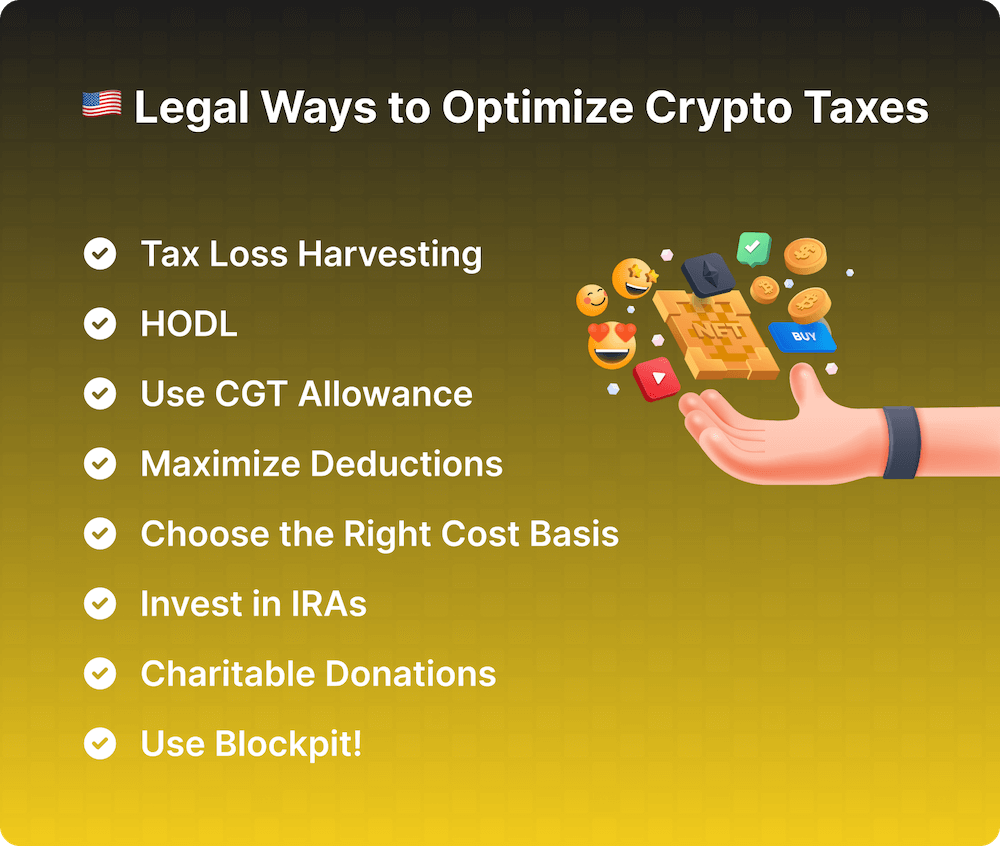

Navigating the Complexities of Crypto Taxes

Keeping accurate records of all your cryptocurrency transactions is essential for accurate tax reporting. This includes purchase prices, sale prices, dates, and amounts. Using specialized crypto tax software can greatly simplify this process and help you identify potential tax-saving opportunities.

Below is a comparative table showing the difference between short-term and long-term capital gains taxes:

| Holding Period | Tax Rate |

|---|---|

| One year or less (short-term) | Taxed at your ordinary income tax rate |

| More than one year (long-term) | Potentially lower tax rates (0%, 15%, or 20%) depending on your income bracket |

Seeking Professional Advice

Given the ever-changing nature of cryptocurrency tax laws and the complexities involved, consulting with a qualified tax professional specializing in cryptocurrency is highly recommended. A professional can provide personalized guidance based on your specific circumstances and help you navigate the intricacies of crypto tax compliance.

Finally, it’s important to remember that understanding cryptocurrency tax laws is your responsibility as an investor. Stay informed, keep accurate records, and don’t hesitate to seek professional help to ensure you are compliant and avoid any potential penalties.