Understanding insurance claims is crucial in navigating the complexities of financial protection. These claims represent a formal request to an insurance company for compensation related to a covered loss or event. The process often involves meticulous documentation, assessment, and eventual settlement, aiming to restore the insured party to their pre-loss financial position. Effective navigation of the insurance claims process can make all the difference in recovering from unexpected circumstances and maintaining financial stability.

What is an Insurance Claim?

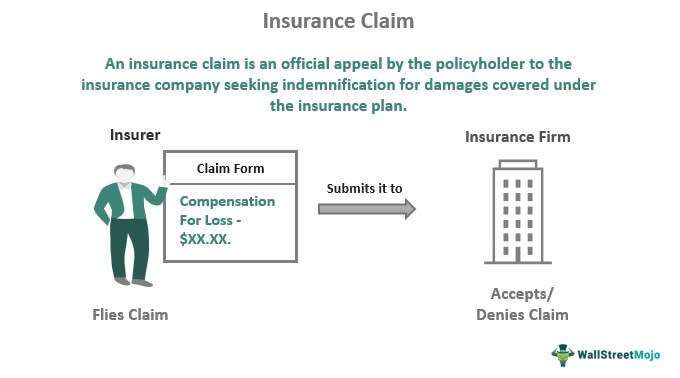

An insurance claim is a request made by a policyholder to their insurance company for compensation for a loss covered by their insurance policy. This loss could be anything from damage to a car in an accident to medical expenses resulting from an illness or injury, or even damage to a home caused by a fire or storm. When a covered event occurs, the policyholder files a claim providing details about the incident and the resulting damages. The insurance company then investigates the claim to determine its validity and the amount of compensation that should be paid.

Key Elements of an Insurance Claim:

- Policyholder: The individual or entity covered by the insurance policy.

- Insurer: The insurance company providing the coverage.

- Covered Event: The specific incident or occurrence covered by the policy (e.g., car accident, fire, theft).

- Loss or Damage: The financial or physical harm resulting from the covered event.

- Claim Documentation: The paperwork and evidence submitted to support the claim (e.g., police reports, medical bills, repair estimates).

Types of Insurance Claims

The specific types of insurance claims you might encounter vary greatly depending on the type of insurance policy you hold. Here are a few common examples:

- Auto Insurance Claims: Cover damages and injuries resulting from car accidents.

- Homeowners Insurance Claims: Protect against damage to your home and belongings from events like fire, theft, or natural disasters.

- Health Insurance Claims: Cover medical expenses such as doctor visits, hospital stays, and prescription medications.

- Life Insurance Claims: Provide a financial benefit to beneficiaries upon the death of the insured.

- Disability Insurance Claims: Provide income replacement if you become unable to work due to illness or injury.

How Insurance Claims Work: A Step-by-Step Guide

The claims process can sometimes feel daunting, but understanding the basic steps can make it more manageable:

- Report the Incident: Immediately notify your insurance company about the covered event.

- Document the Loss: Gather evidence, take photos, and keep records of all related expenses.

- File the Claim: Submit a formal claim to your insurance company, providing all necessary information.

- Investigation: The insurance company will investigate the claim, which may involve interviewing you, gathering information from third parties, and assessing the damages.

- Settlement: If the claim is approved, the insurance company will offer a settlement amount.

- Payment: Once you accept the settlement, the insurance company will issue payment.

Successfully navigating the world of insurance hinges on understanding how insurance works. A smooth claims process requires careful adherence to policy terms and prompt communication with your insurer. Ultimately, understanding the nuances of insurance claims empowers you to protect your financial well-being in the face of unforeseen circumstances.

In my own experience, filing an insurance claim felt like navigating a labyrinth at first. A few years back, a nasty hailstorm turned my car into a golf ball. I immediately contacted my insurance company, feeling a mix of frustration and anxiety. The first hurdle was gathering all the necessary documentation. I took countless photos of the damage, got estimates from several auto repair shops (a crucial step, I learned!), and meticulously filled out the claim forms.

My Auto Insurance Claim Experience

The investigation process took longer than I expected. An adjuster came to inspect my car, and I had to answer a barrage of questions about the incident. Honestly, it felt a bit intrusive, but I understood they needed to verify the legitimacy of the claim. What surprised me most was the back-and-forth negotiation on the repair costs. The initial estimate from the repair shop I preferred was higher than what the insurance company was willing to cover. After some tense phone calls and providing additional documentation (a detailed breakdown of the repair costs from the shop), we eventually reached an agreement.

Lessons Learned from My Claim

- Read your policy carefully: Before filing a claim, understand what is and isn’t covered. I wish I had known my deductible amount by heart!

- Document everything: Photos, receipts, repair estimates – keep everything organized. It saved me a lot of headaches.

- Be patient: The claims process can take time. Don’t be afraid to follow up with your insurance company regularly.

- Negotiate: Don’t automatically accept the first settlement offer. Do your research and know your rights.

The Importance of Understanding Your Coverage

That experience truly drove home the importance of understanding my insurance coverage. I realized I had been paying my premiums without really knowing what I was paying for. I now make it a point to review my policies annually and ask questions about anything I don’t understand. I even considered adding a “gap insurance” policy after that ordeal, just in case my car was ever totaled. The experience also taught me the value of choosing a reputable insurance company. While price is important, so is the level of customer service and the ease of the claims process. I ended up switching to a company with a better reputation for handling claims, even though it meant paying slightly higher premiums. It felt like a worthwhile investment in peace of mind. As a result of that event, I became much more familiar with the world of insurance and the claims process.

Navigating my auto insurance claim was a learning curve, but it ultimately empowered me to be a more informed and proactive policyholder. I hope that sharing my personal experience can help others feel more confident and prepared when faced with their own insurance claims.