Prepaid Expense: Definition‚ Example‚ and Insights

Understanding the intricacies of accounting can sometimes feel like navigating a complex maze‚ but grasping fundamental concepts like prepaid expense is crucial for sound financial management․ A prepaid expense represents a payment made for goods or services that will be received or utilized in the future․ Essentially‚ it’s an asset on a company’s balance sheet‚ reflecting the value of future benefits the company is entitled to․ It’s important to properly account for these expenses to accurately reflect the company’s financial position over time‚ ensuring transparent and reliable reporting․

What Exactly is a Prepaid Expense?

A prepaid expense occurs when a company pays for something in advance‚ before the actual benefit is realized․ This contrasts with regular expenses‚ which are recorded when the goods or services are consumed or used․ Think of it like paying for a year’s worth of insurance upfront – the company has made the payment‚ but the insurance coverage only applies over the coming year․

Common Examples of Prepaid Expenses:

- Insurance Premiums: As mentioned‚ paying for insurance coverage in advance․

- Rent: Paying rent for multiple months ahead of time․

- Subscriptions: Annual subscriptions to software or services․

- Advertising: Paying for advertising campaigns before they run․

- Supplies: Purchasing a large quantity of office supplies that will be used over time․

Why are Prepaid Expenses Important?

Accurately accounting for prepaid expenses is vital for several reasons:

- Accurate Financial Reporting: It ensures that a company’s financial statements reflect a true and fair view of its financial position․

- Matching Principle: It aligns with the matching principle of accounting‚ which states that expenses should be recognized in the same period as the revenues they help generate․

- Tax Implications: Proper accounting can affect a company’s tax liability․

- Better Decision-Making: By having a clear picture of assets and liabilities‚ businesses can make more informed financial decisions․

Accounting for Prepaid Expenses

The accounting treatment for prepaid expenses involves initially recording the payment as an asset on the balance sheet․ As the benefit is received over time‚ the asset is gradually expensed on the income statement․ This is typically done through adjusting entries at the end of each accounting period․

For example‚ if a company pays $12‚000 for a year’s worth of insurance‚ the initial entry would be to debit “Prepaid Insurance” (an asset) and credit “Cash․” Then‚ at the end of each month‚ the company would debit “Insurance Expense” and credit “Prepaid Insurance” for $1‚000 ($12‚000 / 12 months)․ This process continues until the entire prepaid expense has been recognized as an expense․

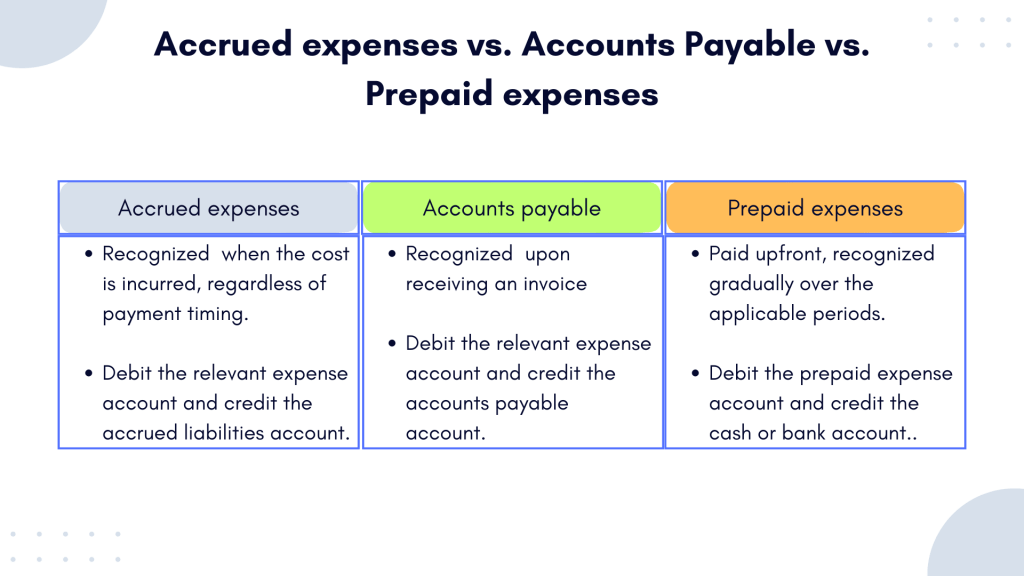

Prepaid Expenses vs․ Accrued Expenses

It’s important to distinguish prepaid expenses from accrued expenses․ Prepaid expenses involve payments made in advance for future benefits‚ while accrued expenses involve expenses that have been incurred but not yet paid․ They represent the opposite sides of the same coin when it comes to recognizing expenses․

Here’s a simple table to illustrate the key differences:

| Feature | Prepaid Expense | Accrued Expense |

|---|---|---|

| Payment Timing | Paid in advance | Not yet paid |

| Accounting Treatment | Initially recorded as an asset | Initially recorded as a liability |

| Example | Prepaid rent | Salaries owed to employees |